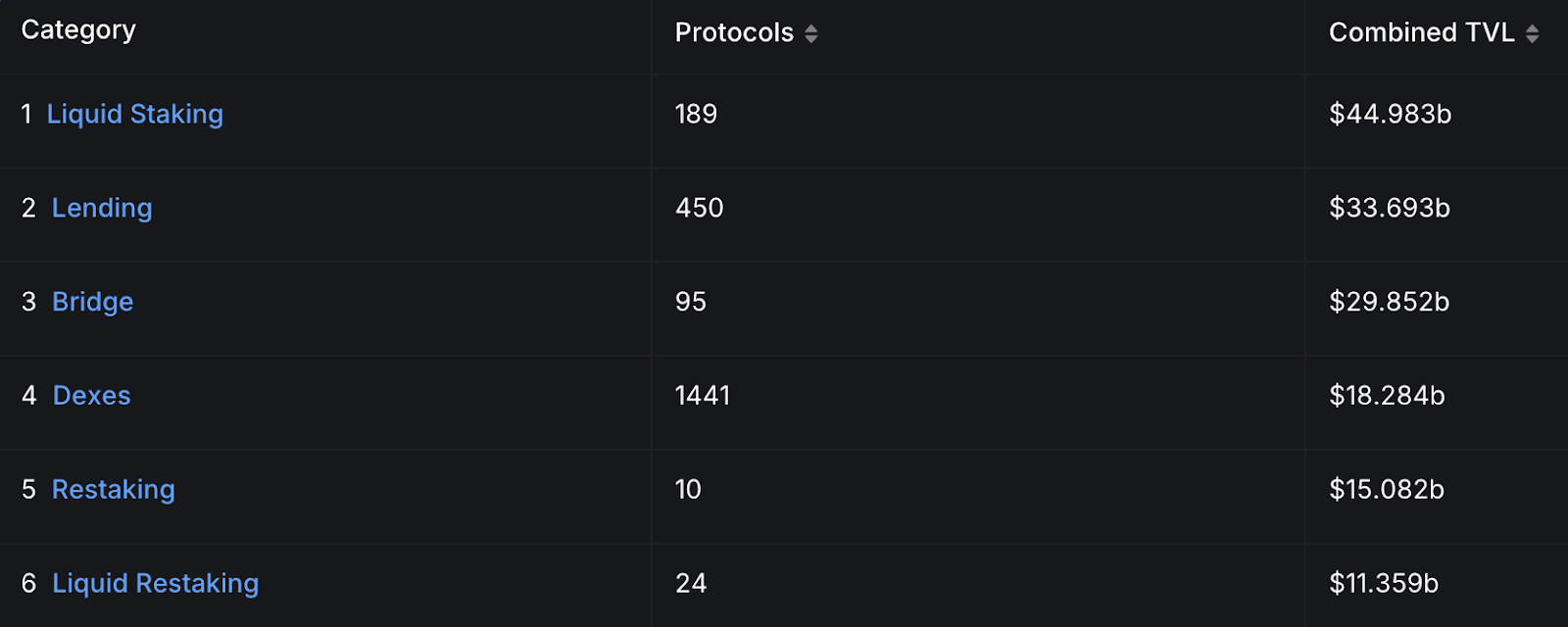

If you've been scrolling through your X feeds or keeping an eye on the crypto space lately, you've probably noticed the buzz around Bitcoin restaking. It's one of the hottest sectors right now, and for good reason. DeFiLlama shows over $15 billion in Total Value Locked (TVL) participating in restaking. On-chain figures are signaling a significant emerging trend that's growing rapidly.

But what exactly is Bitcoin restaking, and why should you care? Let's dive into this evolving landscape to understand its significance, the mechanisms behind it, and what it means for the future of DeFi.

Disclaimer: This blog post is intended for awareness and educational purposes. The information provided may be outdated or incomplete. Readers are encouraged to conduct their own research for the most current data and developments.

Caution: Approach Bitcoin restaking carefully:

- DYOR: The crypto space is dynamic.

- Understand Risks: Smart contract vulnerabilities, market volatility, and regulations can impact investments.

- Stay Updated: Follow official channels for the latest info.

The Rise of Bitcoin Restaking

Bitcoin restaking is gaining momentum, with major protocols like Babylon and Symbiotic leading the charge. Together, they've facilitated the restaking of thousands of Bitcoin, unlocking new opportunities for Bitcoin holders to maximize their assets.

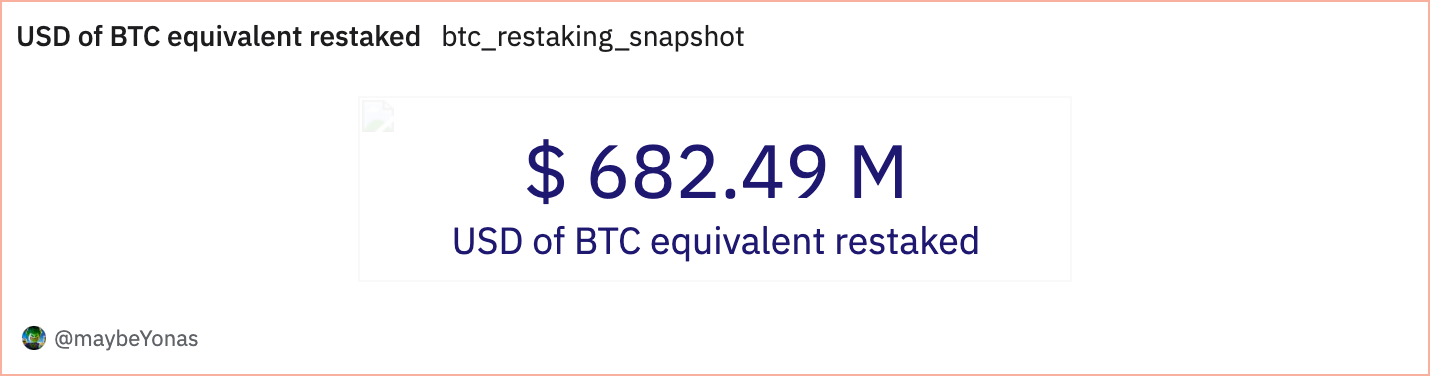

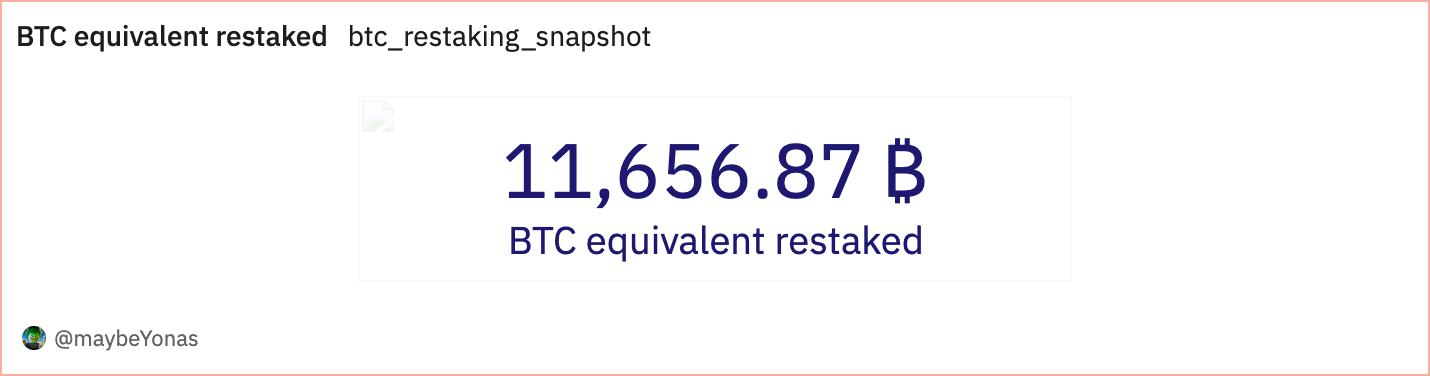

So far, approximately $682.49 million or 11,656.87 Bitcoin have been restaked. This only represents their derivatives such as wrappers and liquid restaking tokens (LRTs) on the Ethereum network.

Babylon

- Total Deposited: Around 1,000 native BTC (~$63.35 million).

While Babylon allows native BTC to be deposited directly into the protocol, the liquidity of depositor’s BTC remains locked within the staking process. To unlock this liquidity and make it usable within DeFi, various LRT protocols have been built on top of Babylon. These protocols accept not only native Bitcoin but also Bitcoin derivatives like wBTC.

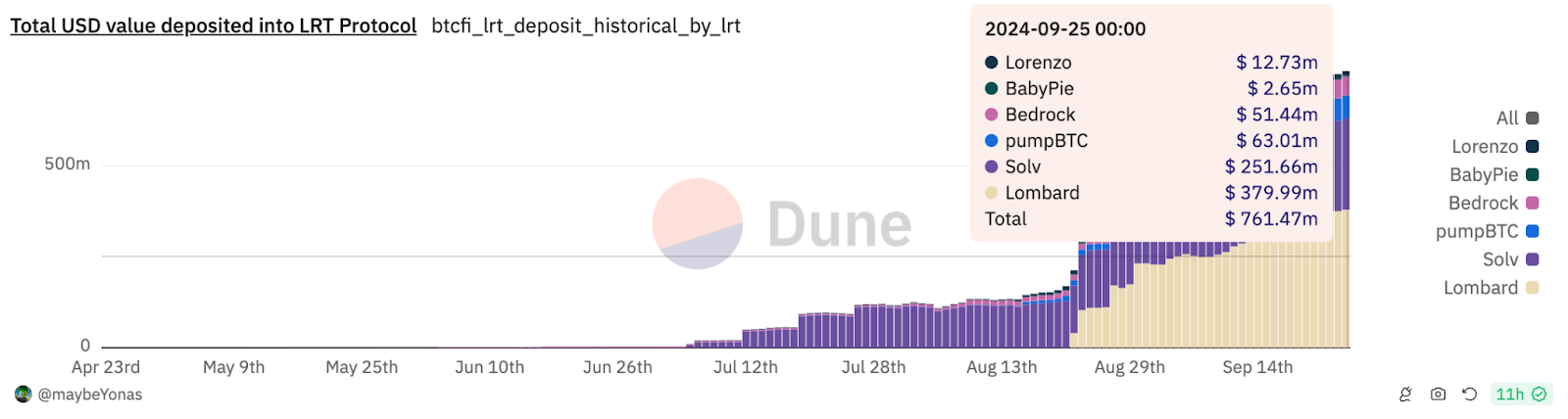

By issuing LRTs that represent the staked Bitcoin in Babylon, these protocols serve as gateways to Bitcoin staking, and they also allow users to participate in DeFi activities while their Bitcoin is staked. The LRT protocols building on top of Babylon are gaining momentum and healthy deposit inflows. Some of the top LRT protocols leveraging Babylon include:

- Lombard's LBTC: 5927 BTC

- Solv's SolvBTC.BBN: 3925 BTC

- PumpBTC: 983 BTC

- Bedrock's uniBTC: 802 BTC

- Lorenzo's stBTC: 198 BTC

Each protocol offers unique mechanisms and benefits, catering to different user preferences. They help unlock the liquidity locked into Babylon staking, enabling users to engage more freely with the DeFi ecosystem.

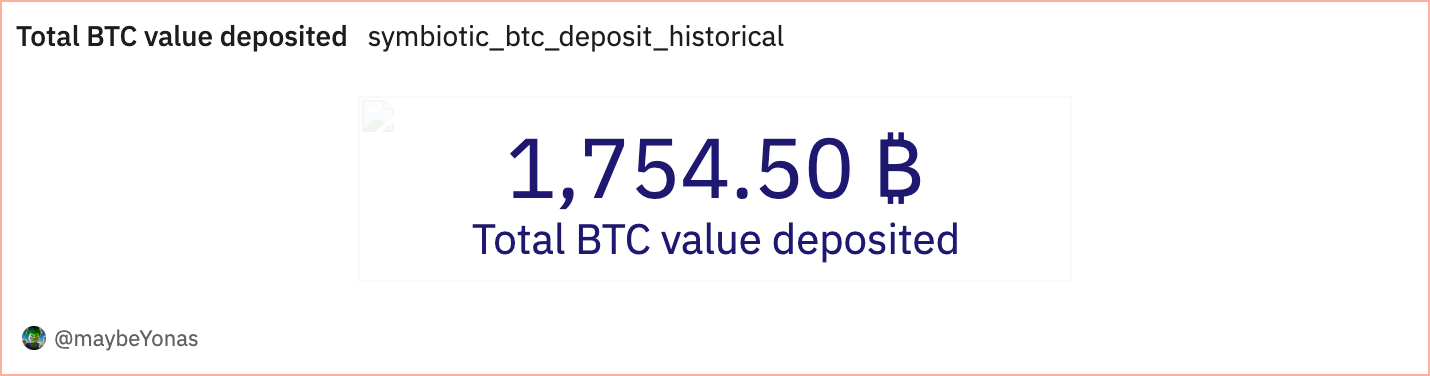

Symbiotic

- Total Deposited: Around $102.72 million or 1,754.5 Bitcoin.

- Top Restaked Assets:

- wBTC: 1,650 BTC (>90% dominance)

- tBTC: 165 BTC

- LBTC : 165 BTC

Similar to Babylon, Symbiotic also serves as a hub for various LRT protocols building on top of it, offering users diverse options for restaking their Bitcoin derivatives. These include:

- EtherFi's eBTC

- Swell's swBTC

- Mellow's amphrBTC & Re7rtBTC

Note: Every protocol mentioned has different features. Always refer to official documentation for detailed information.

How Does Restaking Work?

Here's a simple (generalized) breakdown:

- Deposit Bitcoin or its Derivatives: Users deposit BTC, wBTC, or any liquid restaked Bitcoin variant like LBTC.

- Receive Receipt Tokens: In return, they get a token representing their deposit, which can be used in other DeFi protocols.

- Earn Yield + Rewards: Users earn yield from the underlying staked Bitcoin plus additional perks like protocol tokens or points.

By restaking, you're making your Bitcoin work multiple times over, enhancing capital efficiency.

So, Why Should You Care About Bitcoin Restaking?

Bitcoin restaking isn't just another DeFi buzzword—it could transform your crypto game. Here's why:

- Boost Your Returns: Make your BTC work harder by earning yields through restaking.

- Strengthen Security: Help secure and decentralize blockchain networks with your participation.

- Explore DeFi Without Selling BTC: Dive into lending, borrowing, and more—all while keeping your Bitcoin.

- Unlock Cross-Chain Potential: Restaking connects Bitcoin to other blockchains, opening up new opportunities.

- Increase Liquidity: Add more fluidity to the market; your LRTs can be traded, loaned, or used as collateral.

- Expand the Ecosystem: Be part of the DeFi growth story, driving new financial products and services.

Emerging Applications and Use Cases

The Bitcoin restaking ecosystem is rapidly evolving, with several platforms introducing innovative ways to enhance returns and user engagement. Here are some notable platforms contributing to the growth:

Important: Each platform has its own risks and rewards. Always do your own research before participating. The information provided may be outdated or incomplete.

Pendle Finance

- Opportunity: Deposit LBTC to earn multiple rewards, including tokens from Babylon and Lombard points.

- Mechanism: Enables users to split yield-bearing assets into principal and yield components, allowing for flexible asset management.

- Significance: Facilitates maximized returns through yield tokenization.

Avalon Finance

- Opportunity: Loop SolvBTC.BBN on Binance Smart Chain with low borrowing APY and no risk of depeg liquidation.

- Mechanism: Offers leveraged asset strategies while minimizing exposure to volatility risks.

- Significance: Enhances capital efficiency for staked Bitcoin derivatives.

Gearbox Protocol

- Opportunity: Provides looping options for LBTC.

- Mechanism: Delivers leveraged strategies to amplify asset exposure.

- Significance: Presents advanced methods for maximizing yields, suitable for users comfortable with increased risk.

Morpho Labs

- Opportunity: Offers looping availability for LBTC.

- Mechanism: Optimizes lending by efficiently matching borrowers with lenders.

- Significance: Potentially yields better rates in lending and borrowing markets, improving overall returns.

ZeroLend

- Opportunity: Features an isolated Bitcoin LRT pool utilizing eBTC.

- Mechanism: Creates isolated lending pools to minimize systemic risk.

- Significance: Provides a safer environment for lending and borrowing specific assets.

Photon Labs' PBTC: Empowering the Restaking Ecosystem

Amidst this exciting landscape, Photon Labs' PBTC is set to make a significant impact—not as a competitor, but as an enabler that collaborates with existing protocols.

What is PBTC?

PBTC is a liquid, omnichain, yield-bearing token backed by native Bitcoin and its derivatives. It's designed to integrate seamlessly with various DeFi platforms, enhancing the overall ecosystem.

Key Features of PBTC

- Secure and Trust-Minimized: Assets are secured by institutional-grade, on-chain MPC custody.

- Omnichain Accessibility: Use PBTC across multiple blockchains without traditional bridges.

- Yield-Bearing Asset: Earn passive yields from Bitcoin staking, delta-neutral strategies, and ecosystem incentives.

- Transparent and Auditable: Backing assets can be validated on-chain and independently audited.

How PBTC Works with Other Protocols

- Collaboration Over Competition: PBTC accepts Bitcoin LSTs like those from Lombard and SolvBTC.BBN as backing assets.

- Enabling Enhanced Yield Generation: Aggregates various yield sources, including those from other protocols.

- Simplifying User Experience: Reduces complexity for users navigating multiple protocols.

Mechanics of Creating PBTC

- Deposit or Stake BTC Assets: On their native chains.

- Receive PBTC Without Bridges: Thanks to its omnichain capabilities.

- Earn Passive Yields: From multiple sources. Refer Yield Generation Framework

- Retain Liquidity and Value: Maintain the liquidity of Bitcoin assets.

- Engage in DeFi Activities: Use PBTC in lending, trading, yield farming, and more.

Yield Generation Framework

Photon Labs diversifies yield sources:

- Bitcoin Staking Income:

- Babylon/Symbiotic’s Bitcoin Staking: Leveraging their security-sharing model.

- Integration with LST Protocols: Accepts LSTs as backing assets.

- Delta-Neutral Strategies:

- Market-Neutral Income: Generate returns regardless of market direction.

- Institutional-Grade Strategies: High-yield with minimized risk.

- Scalability and Sustainability: Implemented across centralized and decentralized venues.

- Ecosystem and Partner Incentives:

- Collaborative Rewards: Additional incentives from partners.

Note: Photon Labs is fine-tuning its strategies and is committed to transparency. Refer to official communications for the latest information.

The Future of Bitcoin Restaking

With Bitcoin's security and DeFi's innovation, restaking is set to reshape finance. Anticipate:

- Mass Adoption: User-friendly protocols will drive broader participation.

- Technological Advancements: Improved smart contracts and security measures.

- Ecosystem Collaboration: Projects like PBTC emphasize collaboration, enhancing the ecosystem.

So, the big question is: Are you ready to take the next step?

What's Next?

Bitcoin restaking is just one piece of the puzzle. Bitcoin wrappers also play a crucial role in expanding the ecosystem. Wrappers like wBTC, tBTC, FBTC, and cbBTC allow Bitcoin to be used on other blockchains.

Stay tuned for our next blog post, where we'll explore the Bitcoin wrappers landscape, their benefits, and their impact on DeFi.

.png)