In Part 1 of this series, we introduced the concept of bringing yield into Bitcoin, transforming it from a dormant asset into a dynamic, yield-generating tool.

We discussed Photon’s PBTC, a liquid yield token or liquid (re)staking token designed to provide Bitcoin holders with both yield and liquidity.

In this second part, we will explore the detailed mechanics of PBTC, including its creation, custody, yield generation, and its broader value proposition within the DeFi ecosystem.

The Mechanics of Creating PBTC

Stake (Deposit) & Minting

- Users Stake Bitcoin: Users deposit their Bitcoin and its derivatives (wrapper and liquid staking tokens) from their native chains into the Photon protocol. The process varies slightly depending on the type of deposit token to accommodate different asset types efficiently while maintaining the integrity of the staking mechanism.

- Secure Custody: The Bitcoin backing assets are securely held in institutional-grade, on-chain Multi-Party Computation (MPC) custody by leading digital asset custodians used by institutional participants.

- PBTC Minting: Photon contracts mint PBTC directly based on the PBTC exchange rate on the destination chain, eliminating the need for bridges. PBTC can be redeemed or swapped for BTC at any time.

Yield Generation: One Stake, Multiple Yields

- Staking: The assets backing PBTC earn rewards from Bitcoin staking for validating PoS chains.

- Delta-Neutral Strategies: Photon partners with leading asset management teams to implement delta-neutral trading strategies, including basis trading, market making, and arbitrages. These strategies are designed to generate stable and competitive yields across CeFi and DeFi venues while retaining full BTC holdings. The purpose of delta-neutral strategies is to minimize market risk and earn returns regardless of market volatility.

- On-Chain Activities: PBTC holders have the opportunity to unlock additional yield through various DeFi protocols, including liquidity mining, yield farming, lending, staking, and liquidity provisioning. By engaging in these on-chain activities, PBTC holders can maximize their returns, making the most out of their assets while contributing to the broader DeFi ecosystem.

Yield Accrual Mechanism

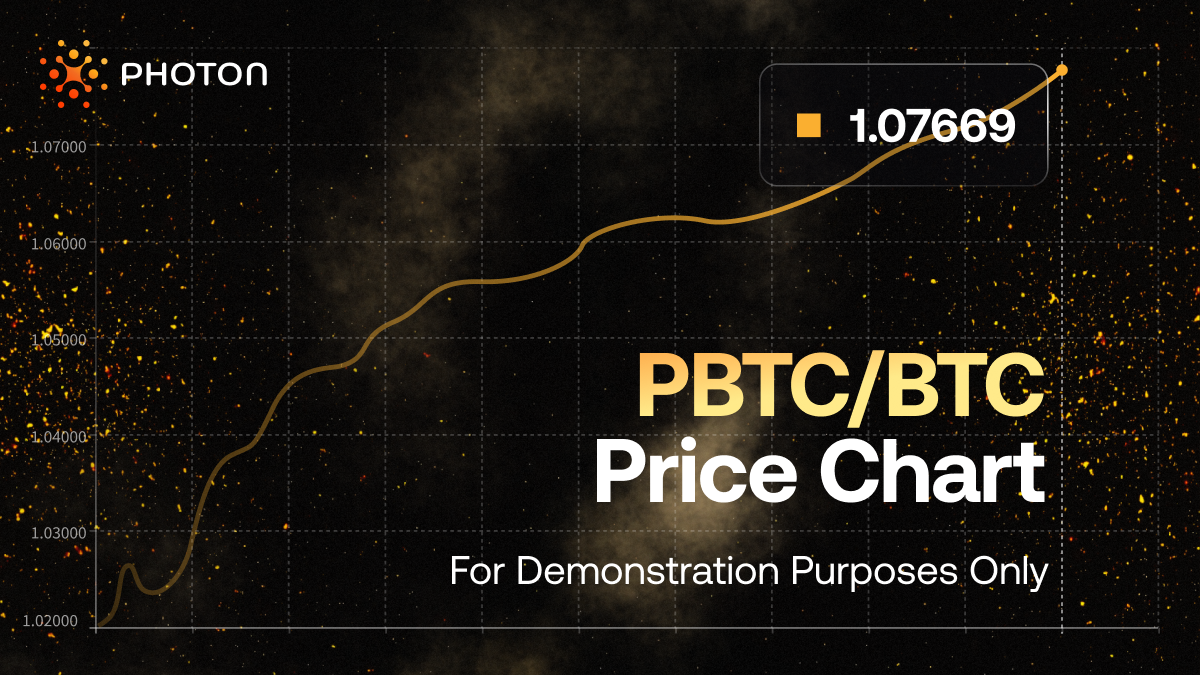

PBTC represents the backing BTC assets plus accrued rewards. Unlike traditional pegged tokens, PBTC does not maintain a 1:1 peg with BTC, making it a non-rebasing token that is easily compatible with DeFi applications. Instead, PBTC operates with a floating conversion rate to BTC, which allows each PBTC token to represent more BTC as rewards accrue. This mechanism is similar to those used by Rocket Pool’s rETH, Coinbase’s cbETH, and Mantle’s mETH.

The conversion rate is periodically updated based on the total controlled BTC within the system divided by the total PBTC supply, effectively distributing yield to PBTC holders. Users can realize their accrued yield by redeeming PBTC or swapping it for BTC through various liquidity pools.

For demonstration purposes only, here is a PBTC/BTC price chart illustrating yield accrual over time.

Why Work With Custodians?

One of the core yield-generation activities involves interacting with centralized liquidity venues, which offer scalability and efficiency. This approach balances scalability and risk management with minimized trust assumptions. To securely hold all backing assets, Photon utilizes third-party MPC custody solutions, such as Copper, Cobbo, Fireblocks, and Ceffu. These solutions enable Photon to delegate assets to centralized venues without transferring ownership, ensuring both security and operational efficiency.

Attributes we focus on:

- Holding assets outside opaque centralized servers without handing over ownership titles.

- Ensuring full auditability and transparency.

- Avoiding reliance on a single source of liquidity and custodian mechanisms.

- Not depending on traditional banking infrastructure.

- Designing scalable, permissionless, and programmatic mechanisms.

PBTC Value Proposition

- Trust-Minimized Operation: PBTC operates within a decentralized framework involving multiple institutions and stakeholders to oversee collateral backing, minting processes, and yield generation. This approach ensures security and scalability while minimizing trust assumptions, thereby mitigating the risks associated with centralized solutions.

- Proof of Custody: All Bitcoin backing PBTC is securely held and transparently accounted for through regular audits and public disclosures. Utilizing MPC technology, custody is distributed across multiple parties, reducing the risk of single points of failure and exploitation.

- Proof of Yield: Yield generated by PBTC is made transparent. Detailed reporting and attestations of yield-generating activities ensure that users can verify the returns from the multilayered yield generation activities.

- Liquid Bitcoin: PBTC provides retained BTC liquidity and value while earning yield, making it programmable and compatible with most DeFi protocols. This allows Bitcoin holders to utilize their assets in various DeFi applications while earning native yield.

- Inclusive BTCFi: Photon facilitates PBTC access to DeFi products and ecosystems, distributing yield-bearing liquidity across DeFi protocols. It serves as a universal store of value and a financialized asset, increasing Bitcoin's utility within the broader financial ecosystem.

The introduction of PBTC marks a significant step up in Bitcoin’s value proposition. By combining the inherent value of Bitcoin with the benefits of yield generation and liquidity, PBTC offers a compelling solution for Bitcoin holders looking to maximize their returns while maintaining security and transparency.

As of 19 July 2024, all public documentation is undergoing an update in the next few weeks. Stay tuned for more updates and insights as we continue to enhance the capabilities of PBTC. Through these advancements, Bitcoin can transform from a passive asset to a dynamic participant in the evolving crypto ecosystem, offering new opportunities for growth and value creation.

.png)